Personal income tax rates, withholding: Amended Okla.

OKLAHOMA TAX BRACKETS 2022 CODE

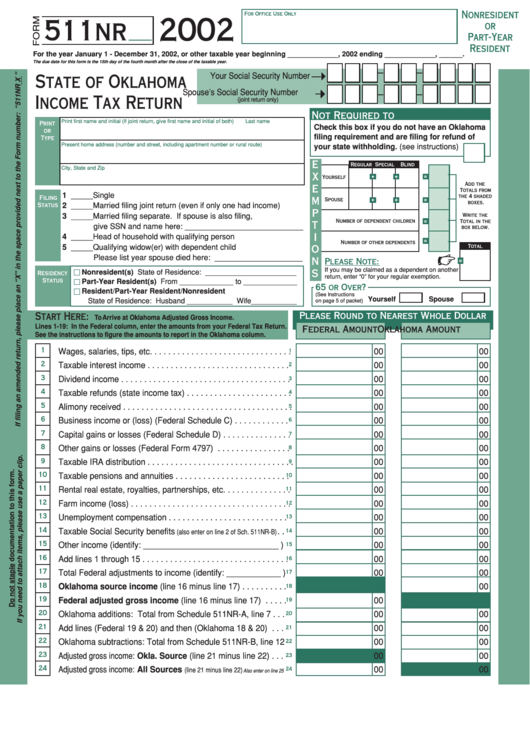

Code § 710:50-13-8 provides that the underpayment period for estimated tax payments runs from the due date of a required installment to the earlier of the 15th day of the fourth month, or for corporations, 30 days after the due date for returns established under the Interanl Revenue Code (previously, the 15th day of the third month) following the close of the taxable year or the date on which the required installment is paid. Interest on estimated tax underpayments: Amended Okla.

Appendix A – Computation of Tax Accrual When Tax Credits Are Allowable is revoked and replaced. Code § 710:50-17-51 states that in computing Oklahoma accrued income tax for corporate income tax purposes, taxpayers should divide the Oklahoma net income by 26 for tax years beginning after December 31, 2021, and divide it by 17.667 for tax years beginning after December 31, 1989, and ending before January 1, 2022.

Oklahoma taxable income adjustment for corporations: Amended Okla. Code § 710:50-17-5 reflects the reduced corporate tax rate of 4% (previously 6%) for taxable years beginning after December 31, 2021. Corporate income tax.Ĭorporate income tax rates: Amended Okla.

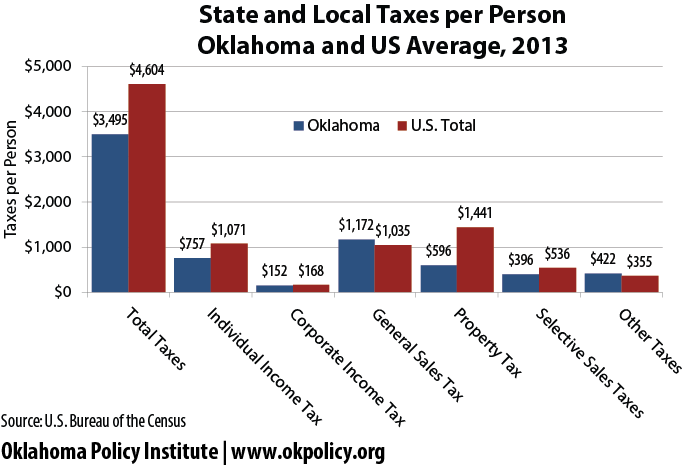

Among the more detailed regulations issued are those related to income tax credits for contributions to public school foundations or public school districts and a manufacturing exemption from property tax. The regulations impact income tax, credits and incentives, sales and use tax, property tax, excise taxes, and administrative provisions. The Oklahoma Tax Commission (OTC) published various new and amended regulations, effective September 11, 2022, that implement tax legislation enacted in 2021.

0 kommentar(er)

0 kommentar(er)